AVGO is a leading semiconductor and infrastructure software company. My analysis leverages a discounted cash flow model, incorporating recent adjustments to reflect Broadcom’s operational dynamics, and is stress-tested through a sensitivity table to provide different views of its intrinsic value. This valuation synthesizes the company’s strong growth trajectory, driven by AI tailwinds and software synergies, against our current uncertain macroeconomic environment

I am valuing Broadcom using fiscal year 2024 numbers (51.57B in revenue, 64% EBITDA margin) as of March 2025. With 20% growth from AI and VMware. I am forecasting five years of cash flows, a discount of 9% WACC, and terminal growth of 3%. This provided me with and Enterprise value of 1079 Billion.

Key assumptions:

Revenue Growth: 20%

EBITDA margin: 64%

WACC 8%

Terminal Growth 3%

Projections table

My valuation is based on the following assumptions, drawn from through analysis of Broadcom’s financials and market positioning:

Revenue Growth:

I project revenue growth at 20% annually from 2025 to 2029, this displays Broadcom’s leadership in AI-driven custom silicon and the scaling of its software business after the VMware acquisition. Revenue grows from $51.57 billion in 2024 to $128.32 billion by 2029, driven by:

AI Semiconductors: Expected to grow 30-50% annually, reaching $16-18 billion in FY2025 alone, fueled by demand from hyperscalers like Google and Meta who have continued to highlight the need for these products.

Software (VMware): Projected to contribute $23-24 billion in FY2025 (10-12% growth) with margins expanding up to 70%+ as subscription models improve.

EBITDA Margins:

A consistent 64% EBITDA margin through 2029 reflects Broadcom’s operational efficiency and the high-margin software business. This yields EBITDA of $82.13 billion by 2029, up from $33.00 billion in 2024.

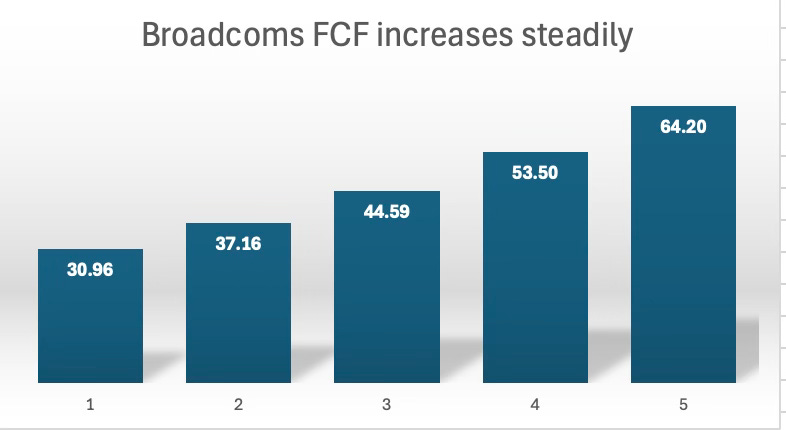

Free Cash Flow (FCF):

FCF is a critical driver of the valuation, growing at 20% annually to $64.20 billion by 2029. Key adjustments include:

Working Capital: Adjusted to -5% of revenue, reflecting Broadcom’s negative working capital dynamics (e.g., deferred revenue from software subscriptions). This releases cash, increasing FCF by ~$5 billion over the forecast period.

Capex: 2% of revenue aligning with Broadcom’s investment needs for AI chip production.

Tax Rate: Fixed at 20%, consistent with historical averages.

Discount Rate (WACC):

I use a base WACC of 8% to show Broadcom’s improving capital structure as it deleverages. At 9% WACC, we account for potential macro risks (rate uncertainty and tariffs)

Terminal Growth Rate:

A 3% terminal growth rate balances Broadcom’s long-term growth potential in AI and software against cyclical risks in the semiconductor sector.

FCF chart

Valuation:

At the base case EV of $1,079.1 billion (8% WACC):

EV/EBITDA: Using FY2025 EBITDA of $39.61 billion, the multiple is 27.2x, in line with high-growth tech peers like NVIDIA (25-30x) and reflecting Broadcom’s AI exposure.

EV/FCF: On FY2025 FCF of $30.96 billion, the multiple is 34.8x, reasonable given 20% FCF growth.

At 9% WACC ($890 billion), the EV/EBITDA drops to 22.5x, closer to the sector average, indicating limited downside risk.

Sensitivity table

Bull Case (WACC 8%, Growth 4%): EV reaches $1,315 billion ($269/share), a 45% upside, assuming sustained 20% growth and a change to a positive macro environment.

Bear Case (WACC 10%, Growth 2%): EV falls to $677 billion ($131/share), a 30% downside, reflecting a slowdown in AI capex and higher discount rates.

The market’s current EV of $935.9 billion (market cap $875 billion + net debt $60.9 billion) sits between the base case at 9% WACC ($890 billion) and 8% WACC ($1,079 billion), suggesting the market is pricing in a WACC of ~8.5% and terminal growth of ~3.2%.

Investment Thesis and Risks

Broadcom’s valuation is underscored by its dual growth pipelines:

AI Dominance: Custom chips for hyperscalers position Broadcom to capture a significant share of the AI capex boom, with semiconductor revenue potentially doubling to $60 billion by 2029.

Software Synergies: VMware’s integration is on track to deliver $20 billion+ in revenue at 80% margins, providing a stable, high-margin cash flow stream to fund deleveraging and dividends.

Significant risks:

Macro Headwinds: A slowdown in tech capex or U.S.-China trade tensions (e.g., tariffs) could cap semiconductor growth at 15%, reducing EV to ~$850 billion.

Execution Risk: VMware margin expansion to 80% requires flawless integration; any slippage could limit EBITDA growth.

Valuation Stretch: At 27x EV/EBITDA, Broadcom trades at a premium, leaving little room for error if growth falters.

Recommendation

AVGO has been in a negative downtrend over the current market sell off impacting high growth/valuation companies. Although a bottom has not be recognized yet, the current price action that AVGO trades at is enticing based on my valuation. I view Broadcom as a Buy with a price target of $216 (based on 8% WACC, 3% terminal growth), offering major upside. The stock’s valuation reflects its leadership in AI and software, supported by robust FCF growth and deleveraging potential. Investors should monitor Q3/Q4 FY2025 earnings for confirmation of 20% growth, particularly in AI revenue (target: $4.5 billion+/quarter) and VMware margins (target: 75%+). On dips below $180, Broadcom presents a compelling entry point for long-term investors. In the short term, I would wait to identify a level of price stability before entering.